We’re back with another round of product updates to the iJoin experience. Below you’ll find the latest features now available, along with a sneak peek at what’s on the horizon.

Recently Released

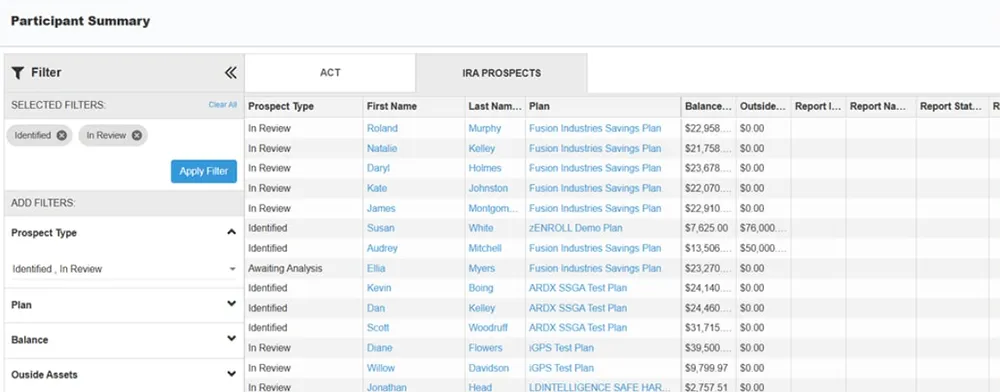

1. IRA Clarity™

An all-new Voluntary/Advisor Directed IRA rollover solution for advisors, this automated end-to-end workflow identifies and engages eligible participants, integrates Broadridge’s Decision Optimizer for suitability, and leverages PenChecks’ NextLevel IRA™ platform to help retain assets and ensure continuity of advice.

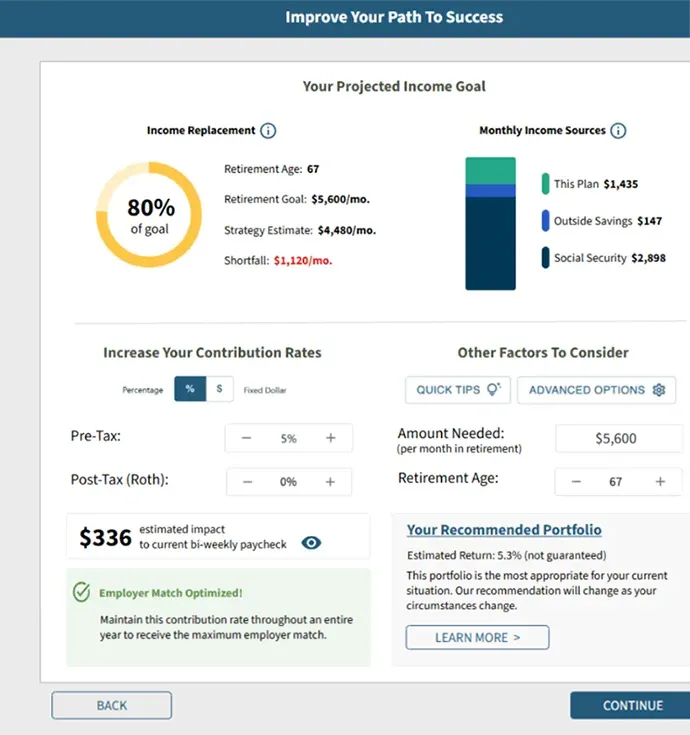

2. PGIM RetireWell™ Managed Accounts

A new addition to the iJoin MAP marketplace that uses PGIM’s advice engine to create personalized portfolios and savings strategies based on the plan’s current fund lineup.

3. Re-enrollment Blueprint

A comprehensive, white label resource with sales and marketing materials and operational guides to help you communicate the value of plan re-enrollment and seamlessly implement the process from start to finish. The Re-enrollment Blueprint is now available in the new iJoin Success Hub! (login required)

Coming Soon

1. Register for our next demo and Q&A now!

Our Q1 2025 “What’s New at iJoin” Demo & Q&A session will be held on April 10th at 10am PT / 1pm ET. Save your seat here!

2. Relius File-Based Bulk Extract

An alternative to the current sync process will make it easier and more efficient to transfer data between Relius and iJoin.

3. TIAA Lifetime Income

A new addition to the iJoin income marketplace that will support TIAA’s Secure Income Account, offered either through a managed account or a target date fund series. The iJoin participant experience will support income projections and essential expense coverage estimates, while managing backend processes with your recordkeeping system.

4. Allianz Lifetime Income

A series of enhancements to the Allianz Lifetime Income+ solution that will further streamline the operational aspects of trading the product solution.

5. UI Refresh

A refreshed user interface with updated styling and branding. While the overall experience and workflows remain the same, these visual enhancements will bring a more modern and polished look to the platform.

Tip of the Day

Did you know?

You can run a Suitability Report to compare a plan’s current target date fund series to a managed account solution of your choice, illustrating each participant’s equity exposure in both options. This easy-to-read chart helps advisors and plan sponsors assess investment suitability and improve retirement outcomes.

As always, if you have any questions, insights, or suggestions, feel free to reach out. We’d love to connect with you!