We’ve kicked off 2025 with some exciting updates to iJoin. As part of our dedication to keeping you informed, this month’s email highlights the latest features we’ve rolled out and provides a glimpse into what’s coming next.

Recently Released

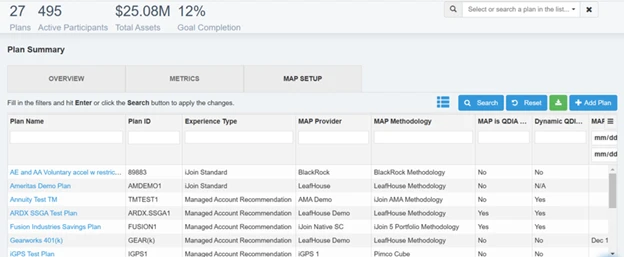

1. Admin Views

Based on feedback from iJoin admin users, we’ve introduced new plan views to improve visibility into settings across all of your organization’s plans. These specialized views focus on settings related to Enrollment, Managed Accounts, IRA Rollovers, and more. This is just the first step in a series of updates designed to make it easier to perform batch updates across segments of plans.

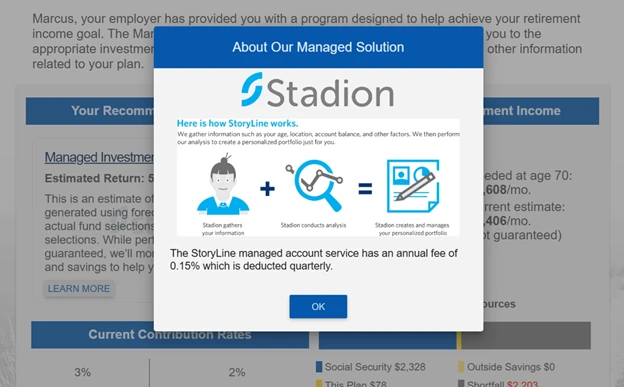

2. Stadion Managed Accounts

We are proud to introduce Stadion as a new managed account marketplace option. This user experience is fully integrated with the Stadion advice engine to create personalized portfolios using the plan’s fund lineup.

3. Miscellaneous Enhancements Requested by Users

- The “Impact to Paycheck” illustration inside the participant UX has been enhanced to reflect the tax benefit of a Roth contribution.

- MAP Fee Reporting: The “Fee Totals By Plan” report view now includes the total managed assets used for the calculation.

- Non-Admin users will no longer be able edit or update plan specification settings in the iJoin portal.

Coming Soon

1. Relius File-Based Bulk Extract

An alternative to the current sync process, making it easier and more efficient to transfer data between Relius and iJoin.

2. PGIM RetireWell™ Managed Accounts

A new option in the iJoin MAP marketplace that uses PGIM’s advice engine to create personalized portfolios and savings strategies based on the plan’s current fund lineup.

3. TIAA Lifetime Income

A new option in the iJoin Income marketplace that supports TIAA’s Secure Income Account, offered either through a managed account or a target date fund series. The iJoin participant experience will support income projections and essential expense coverage estimates, while handling all necessary backend processes with your recordkeeping system.

4. IRA Clarity

Identifies ideal IRA rollover candidates and sends automated emails to them. This feature integrates with the Broadridge Decision Optimizer for compliance and PenChecks NextLevel IRA for account opening.

5. Re-enrollment Blueprint

A comprehensive resource designed to support both sales and operations teams. It provides marketing materials, research, and best practices to help recordkeepers and plan advisors explain the benefits of re-enrolling participants and using managed accounts as the QDIA, along with detailed, step-by-step guidance for implementing the re-enrollment process.

6. UI Refresh

A refreshed user interface with updated styling and branding. While the overall experience and workflows remain the same, these visual enhancements will bring a more modern and polished look to the platform.

Tip of the Day

Did you know?

You can run an Outside Assets Report with ACT-enabled plans. This report helps advisors and plan sponsors see aggregated assets for participants who have linked their outside accounts, and gives a more complete view of retirement readiness and potential rollover opportunities.

We appreciate your partnership and look forward to continuing to enhance iJoin’s functionality together this year.

If you have any questions, feedback, or ideas, don’t hesitate to reach out—we’d love to hear from you. Here’s to a successful 2025!